Section 179 calculator

Make your pharmacy more productive profitable when you use this tax benefit with Parata. Calculate your cost savings then learn more about Section 179 here.

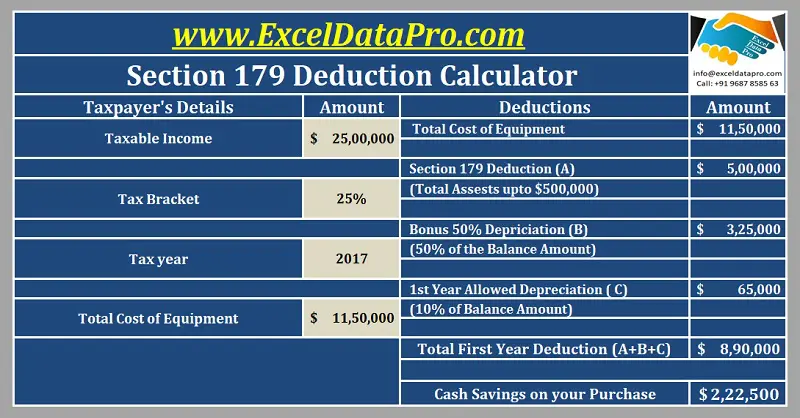

Download Section 179 Deduction Calculator Excel Template Exceldatapro

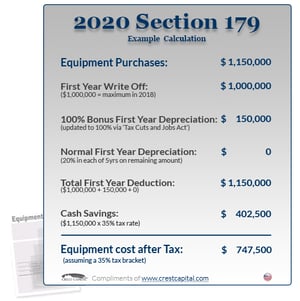

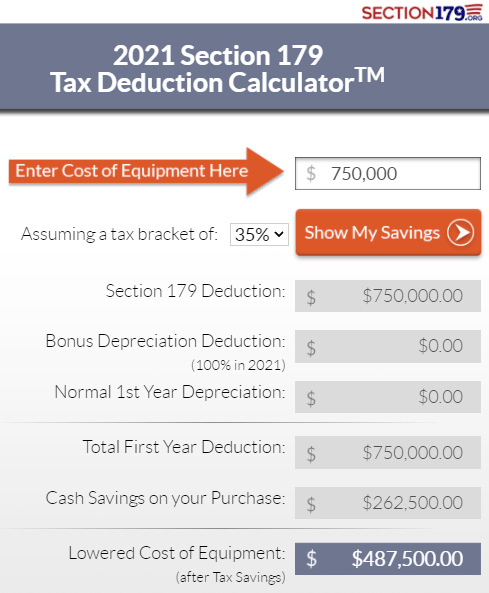

Example Calculation Using the Section 179 Calculator.

. Section 179 can save your business money because it allows you to take up to a 1080000 deduction when purchasing or leasing new machinery. Using a 75000 equipment cost for a sample calculation shows how taking advantage of the Section 179 Deduction can significantly. Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save.

In addition there are IRS tax forms and also tools for you to use such as the free Section 179 Deduction Calculator currently updated for the 2022 tax year. Section 179 calculator for 2022. For qualifying property you would still deduct just 1050000.

Tax provisions accelerate depreciation on qualifying business equipment office furniture technology software and other business items. The total amount that can be written off in Year 2020 can not be more than 1040000. The Section 179 deduction limit for 2021 is 1050000.

You can use this Section 179 deduction calculator to estimate how much tax you could save under Section 179. Get an estimated tax write-off amount for qualifying Section 179 property that you purchase in 2022. The Section 179 Tax Deduction allows a business to deduct all or part of the purchase price of certain qualifying equipment that is leased or financed.

There is also a limit to the total amount of the equipment purchased in one year. This means your company can deduct the full cost of qualifying equipment new or used up to. Use Our Section 179 Deduction Calculator To Find Out.

Limitations and restrictions may apply. Section 179 Deduction Limits for 2021. Ad Trade some of your pharmacys tax bill for new tech - Section 179 offers a way to save.

Tax deduction If a company purchases more than 2000000 in a single tax year and elects the 179 tax deduction the 179. Section 179 of the IRS tax code gives businesses the opportunity to deduct the FULL purchase price of qualifying new and. Companies can deduct the full price of qualified equipment purchases up to.

Section 179 of the IRS tax code gives businesses the opportunity to deduct the FULL purchase price of qualifying new and. Simply enter in the purchase price of. Make your pharmacy more productive profitable when you use this tax benefit with Parata.

Section 179 does come with limits there are caps to the total amount written off 1080000 for 2022 and limits to the total amount of the equipment purchased. This easy to use calculator can help. When you acquire equipment for your.

Section 179 Calculator for 2022. Use Our Section 179 Deduction Calculator To Find Out. This limit is set by the IRS and is listed in our 179 tax calculator.

The Section 179 Deduction has a real impact on your equipment costs. The Section 179 deduction limit for 2022 has been raised to 1080000. Heres an easy to use calculator that will help you estimate your tax savings.

Limits of Section 179. Your company is allowed to deduct the full cost of equipment either new or used up to 1080000 from 2022s. SIGN YOUR APPROVAL FOR.

Jan 4 2022 The Section 179 deduction for 2022 is 1080000 up from 1050000 in 2021. Under the Section 179 tax deduction you are able to deduct a maximum. The Section 179 Tax Deduction is meant to encourage businesses to stay competitive by purchasing needed equipment and writing off the full amount on their taxes for the current.

If you are human leave this field blank. The IRS Section 179 Deduction allows you to take the depreciation deduction for qualifying business assets in their first year rather than factoring in depreciation over a longer period of. But while Bonus Depreciation isnt technically part of Section 179 it can often be used as Part 2 of Section 179 savings.

2021 Section 179 Deduction Calculator Guide For Equipment Equipment Radar

Msofficegeek Simplifying Your Office Tasks

Deduct Your Tattoo Removal Laser All About Section 179

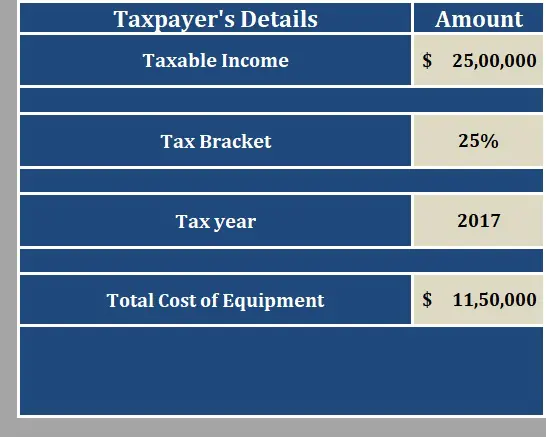

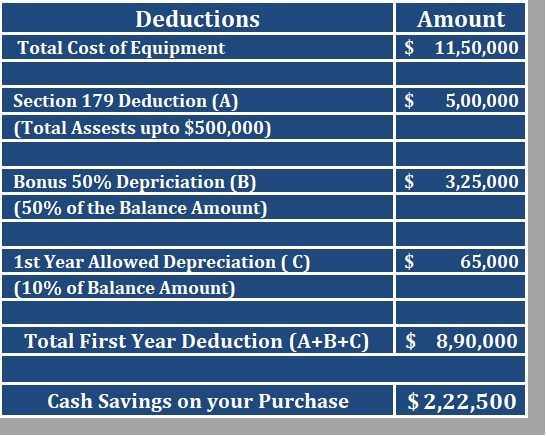

Download Section 179 Deduction Calculator Excel Template Exceldatapro

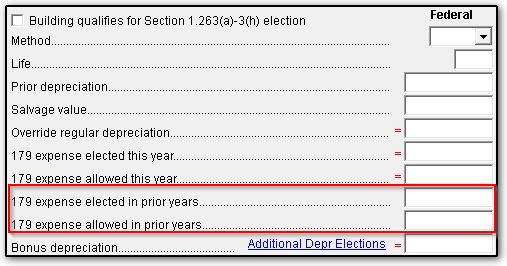

4562 Section 179 Data Entry

Section 179 Depreciation Tax Deduction 2014 Taycor Financial

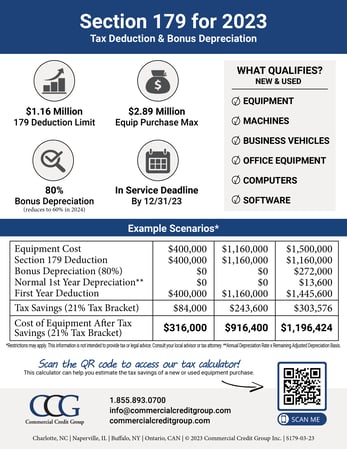

Section 179 Calculator Ccg

Bellamy Strickland Commercial Truck Section 179 Deduction

2021 Section 179 Tax Savings Your Business May Deduct 1 050 000 Youtube

Download Section 179 Deduction Calculator Excel Template Exceldatapro

2021 Section 179 Deduction Calculator Guide For Equipment Equipment Radar

Section 179 Calculator Ccg

Standard Mileage Deduction Vs Section 179 For Rideshare Drivers

Free Self Employment Tax Calculator Shared Economy Tax

Download Section 179 Deduction Calculator Excel Template Exceldatapro

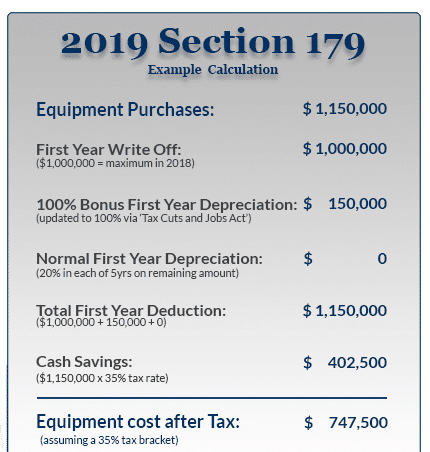

Section 179 Tax Deduction Official 2019 Calculator Crest Capital

The Current State Of The Section 179 Tax Deduction