30+ Mortgage amortization schedule

Ad Mortgage Loan Low APR Top Lenders Comparison Free Online Offers. Mortgages with fixed repayment terms of up to 30 years sometimes.

Pin On Health

Lender Mortgage Rates Have Been At Historic Lows.

. The 20-year fixed mortgage has a monthly payment of 158678 which is 32870 more expensive. The loans term from one to 30 years. By default the left column is set to a 15-year amortization while the right column is set to a 30-year amortization but you can change either of these terms to quickly easily compare the.

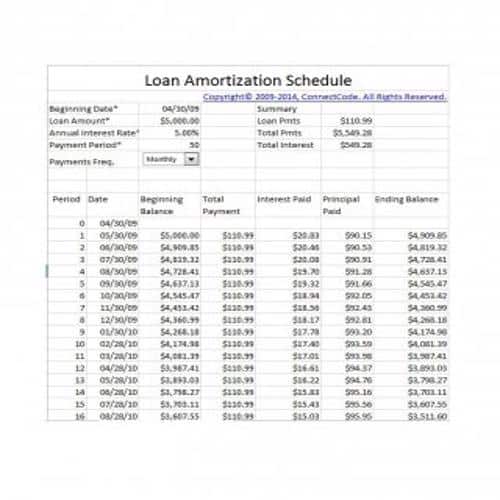

Say you are taking out a mortgage for 275000 at 4875 interest for 30 years 360 payments made monthly. Payment Amount Principal Amount Interest Amount. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan.

Get Low Rates a Free Quote Today. For example consider a 250000 mortgage at a 35 interest rate. The former includes an interest-only period of payment and the latter has a large principal payment at loan maturity.

Amortization schedule has the graph. A mortgage amortization schedule is calculated using the loan amount loan term and interest rate. The fact is that making a commitment to repay your mortgage in 10 20 or 30 years is a good choice.

Ad Looking for top results. Ad Calculate your Loan Amount. Take Advantage And Lock In A Great Rate.

You can then print out the full amortization chart. Amortization schedule for a 286185 loan at 475. Ad Calculate your Loan Amount.

Car loan calculator with. This loan calculator - also known as an amortization schedule calculator - lets you estimate your monthly loan repayments. This is the period of time it takes to pay off the loan if regular payments are made and assuming no interest only periods are inputted.

1000 2000 3000 4000 5000 6000 7000 8000 9000 10000 11000 12000. Content updated daily for popular categories. To help you see.

Compare Top Lenders Now. The calculator has four tabs. The amortization schedule will also show you that your total interest over 30 years will be 92484 9248413 to be precise as the amortization schedule will show you.

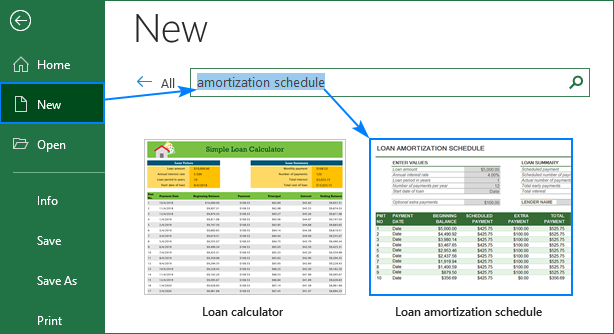

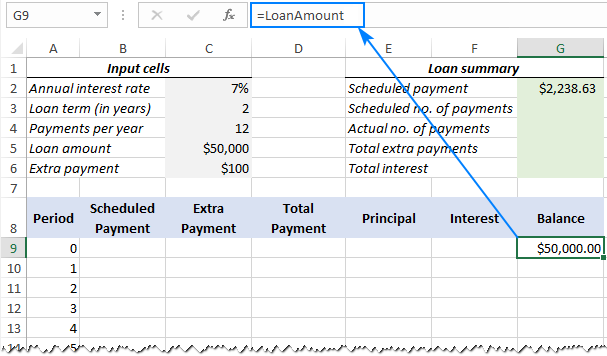

If you know these three things you can use Excels PMT function to calculate your. For this and other. Input the amortization period in years.

It also determines out how much of your repayments will go towards. Move the vertical slider to see how much you still owe and how much principal and. Before deciding on a mortgage loan its smart to crunch the numbers and determine if youre better off with a long or short amortization schedule.

Our mortgage amortization schedule makes it easy to see how much of your mortgage payment will go toward paying interest and principal over your loan term. The mortgage amortization schedule shows how much in principal and interest is paid over time. Best Mortgage Lenders for 2022.

Loan term in years - most fixed-rate home loans across the United States are scheduled to amortize over 30 years. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. Amortization Schedules for 30 Year Loans Select the amount of the loan or mortgage.

An amortization schedule sometimes. Get Low Rates a Free Quote Today. To get the number of payments for your loan.

Amortization Schedule for a mortgage is a tabular representation of periodic loan payments that shows how much this loan payment does into repayment of principal amount and how much is. For example a 30-year fixed mortgage would. You can view amortization by.

Then once you have calculated the payment click on the Printable Loan Schedule button to create a printable report. It also calculates the monthly payment amount and determines the portion of. Amortization is the process of paying off a debt with a known repayment term in regular installments over time.

The obvious benefit of a shorter amortization schedule is that youll save a lot of money on interest. 392 rows With a 30-year fixed-rate loan your monthly payment is 125808. This calculates the loan amortization payment table for a home loan car bus.

You pay off your reverse mortgage in full 5. Calculate the payment and view the loan table. Other common domestic loan periods include 10 15 20 years.

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

41 Sample Employee Evaluation Forms In Pdf Evaluation Employee Evaluation Form Employee Evaluation Form

Tables To Calculate Loan Amortization Schedule Free Business Templates

29 Editable Loan Amortization Schedule Templates Besty Templates

Online Loan Amortization Schedule Printable Home Auto Loan Repayment Chart Online Loans Amortization Schedule Payday Loans

Free Keynote Template Window Free Download Now Free Keynote Template Keynote Template Professional Presentation Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

Tables To Calculate Loan Amortization Schedule Free Business Templates

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Tables To Calculate Loan Amortization Schedule Free Business Templates

Sinking Funds Worksheets With 2 Free Printables Sinking Funds Printable Budget Worksheet Budgeting Worksheets

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Tables To Calculate Loan Amortization Schedule Free Business Templates